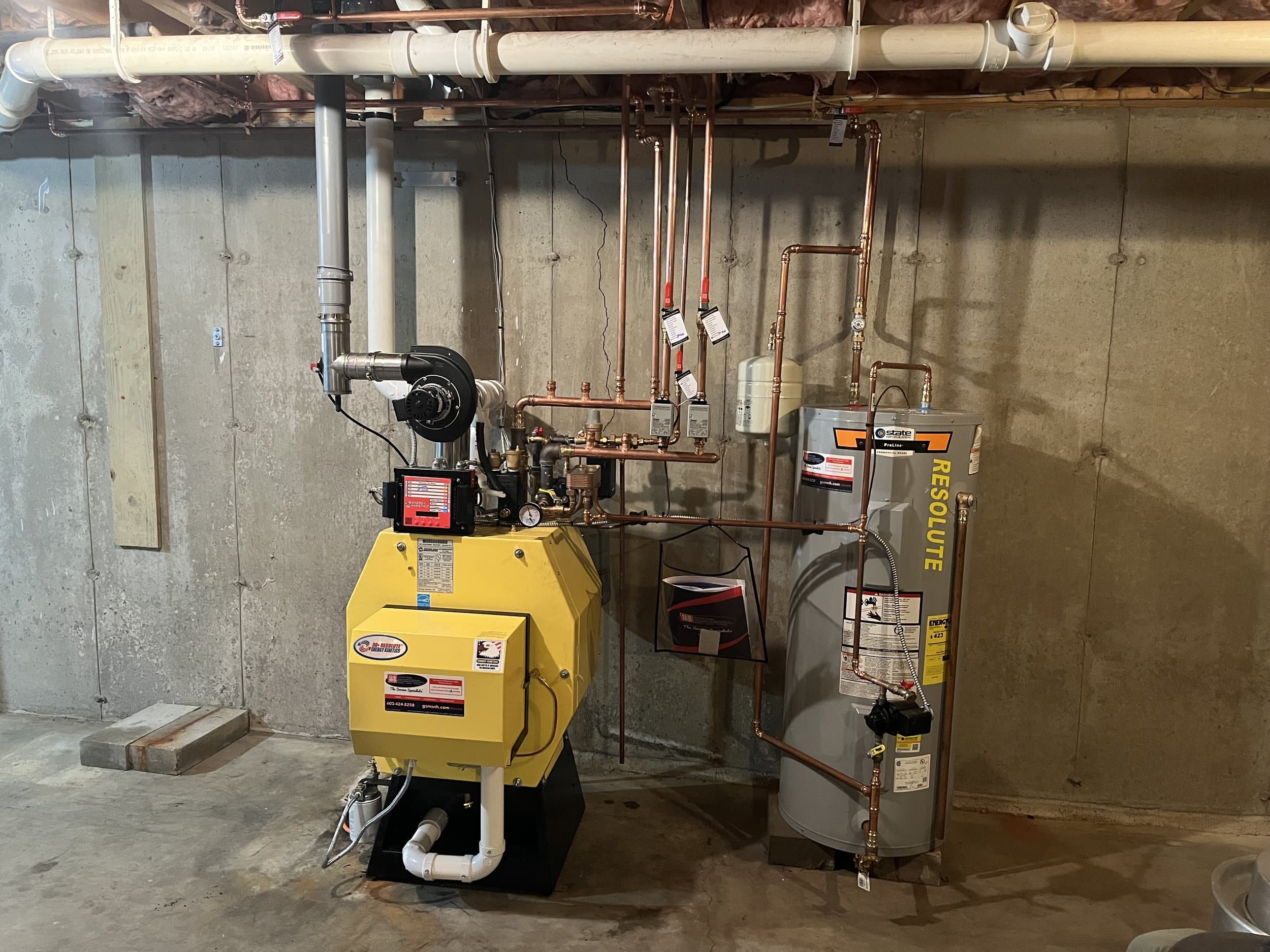

Good news for New Hampshire homeowners! The Inflation Reduction Act of 2022, as authorized by Congress, offers individual tax credits for qualified improvements to HVAC equipment in primary residences. If you've been considering upgrading your oil hot water boiler, now is the perfect time to do so. The tax credit, which can be as much as $600, is a great incentive to enhance your home's energy efficiency and reduce your tax burden. In this blog post, we'll break down the details of this exciting opportunity and introduce you to Energy Kinetics residential oil boilers that meet the eligibility criteria.

Understanding the Tax Credit

The tax credit, effective for oil hot water boilers placed in service after December 31, 2022, and before January 1, 2027, provides homeowners with an opportunity to save up to $600. To qualify, the boiler must meet the following criteria:

-

ENERGY STAR® Efficiency: The boiler must meet or exceed the 2021 ENERGY STAR efficiency criteria, with an Annual Fuel Utilization Efficiency (AFUE) of 87 or greater.

-

Biodiesel Compatibility: The boiler must be rated by the manufacturer for use with fuel blends, at least 20 percent of which consists of biodiesel.

We're proud to share that Energy Kinetics residential oil boilers not only meet but exceed the required ENERGY STAR efficiency criteria. These boilers are also suitable for use with up to B100 biofuel, exceeding the 20 percent minimum required in the eligible fuel criteria. Even before the B100 certification, these models were certified for use with B20 dating back to 2021, making them eligible for the tax credit if placed in service after December 31, 2022.

The following Energy Kinetics oil boilers are eligible for the tax credit as identified on IRS Form 5695 line 24a:

It's important to note that while these models qualify for the tax credit, it is highly recommended to consult with a tax professional to ensure all requirements are met. They can guide you through the process, ensuring that you have the necessary documentation and meet all criteria to maximize your tax savings.

Conclusion

Upgrading your oil hot water boiler not only enhances your home's comfort and energy efficiency but also provides an opportunity for significant tax savings. The tax credit authorized by the Inflation Reduction Act of 2022 is a fantastic incentive for New Hampshire homeowners to make qualified improvements to their HVAC systems. If you're considering a boiler upgrade, Energy Kinetics residential oil boilers offer the perfect blend of efficiency and eligibility for the tax credit. Don't miss out on this opportunity—reach out to us today!